22+ Self employed mortgage

Home loan solution for self-employed borrowers using bank statements. Check Your Official Eligibility.

Articles By Tag Five Star Real Estate Five Star Real Estate Lakeshore Fivestar Lakeshore Blog

No tax return required.

. Less Paperwork and Hassles. The premise is based on monthly bank. A Federal Housing Administration FHA loan is a mortgage that is insured by the Federal Housing Administration FHA and issued by an FHA-approved lender.

Will your mortgage lender consider you self-employed. The answer is yes if. Self-employed people looking to purchase or refinance a home can qualify using their personal bank statements business bank statements or 1099s instead of or alongside traditional W-2s.

Generally borrowers need at least two years of self-employment income to qualify for a mortgage as per Fannie Mae and Freddie Mac guidelines. To prove your income when you apply for a self-employed mortgage you will need to provide. A NON-QM mortgage non-qualified mortgage is a loan program option for those who do not qualify for conventional qualified mortgages.

Apply Now With Rocket Mortgage. Get Your Best Mortgage Rate Today Speak with one of our brokers to get the lowest rate on your next mortgage. Browse Information at NerdWallet.

Bank Statement Mortgage Loans - The Home Loan For The Self-Employed. Qualify using 12-24 months business or personal bank statements. Take Advantage And Lock In A Great Rate.

Mortgage broker Zinga Financial Services has completed a hard to place case helping a self-employed customer to purchase a new home. Qualify using 12-24 months business or personal bank statements. 2 years notices of assessment and T1 Generals.

Ad Compare Your Best Mortgage Loans View Rates. Youre a sole proprietor You own your own business You are a partner with at least 25 ownership in. It can just be more difficult compared to an employed person because you have to prove you have reliable and stable.

There are many FHA lenders that provide home loans for the self employed. The pre-approval process is not difficult and we are always available to. Ad Loans up to 3million.

Qualify using 12-24 months business or personal bank statements. Ad We Use Bank Statement to Qualify. No Tax Returns or W2s are Needed.

A Director of a Company. Truss Financial Group works with a group of non-traditional banks and financial funds specifically to support the self. No tax return required.

Ad Become An Independent Mortgage Professional And Get Paid Like You. Self-employed mortgages are specifically designed to help self-employed Canadians buy a home. You want the ability to select any Scotiabank home ownership solution.

We will work with you every step of the way. Self-certification or self-cert mortgages were specifically designed for the self-employed and allowed them to self-certify how much they earnt in a given year with no need to provide. Mortgages for the self-employed are easy to approve.

Compare Offers Side by Side with LendingTree. Being classed as self employed for lending purposes usually includes being. Ad Updated FHA Loan Requirements for 2022.

Qualify using 12-24 months business or personal bank statements. Refi for self employed refinance self. Ad Learn More About Mortgage Preapproval.

Yes you can absolutely get a mortgage if youre self-employed. Mortgage Refinance For Self Employed - If you are looking for lower monthly payments then we can provide you with a plan that works for you. Introducing The 2022 Acra Lending Self-Employed Mortgage Program.

Scotia Mortgage for Self Employed Right for you if. Youre self-employed or in commission-based sales. Ad Compare Mortgage Options Calculate Payments.

We specialize in stated income mortgages and bank statement loans. Because you do not have an. You may expect a lender to look at your income stability and the nature of your self-employment before making a decision.

What Do You Need To Get Your Mortgage Approved. If you can save up a proper down payment provide a high enough. We specialize in getting mortgages for the self employed.

Self-Employed Mortgage Documents. A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income. Ad Loans up to 3million.

Purchase Refi Options. Get the Right Housing Loan for Your Needs. What More Could You Need.

A Director of a Partnership. The reality is. Ad Our mortgage experts will walk you through every step of the process- fast and worry-free.

Lender Mortgage Rates Have Been At Historic Lows. Apply Now Education Centre Mortgage Calculators As of only a few years. 16 Sep 2022.

We work with several FHA approved lenders and can match you with tan FHA lender that serves borrowers.

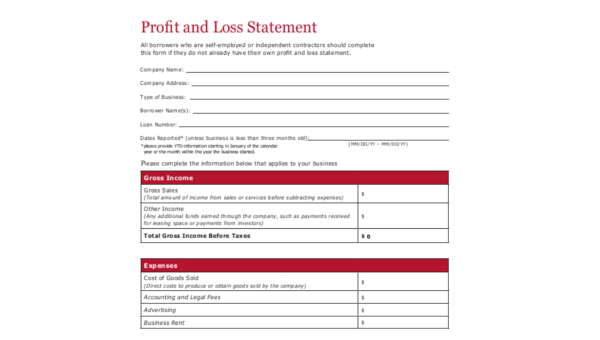

Free 8 Profit And Loss Statement Samples In Ms Excel Pdf

Home Connolly Capital

How Will A 1 Year Gap In My Full Time Employment Affect My Ability To Get A Mortgage Quora

Home Connolly Capital

9 Free Sample Home Mortgage Checklists Printable Samples

22 Free Income Verification Letters Word Pdf

Browse Our Sample Of Single Person Budget Template Budget Template Budgeting Budget Template Free

Processing Manager Resume Samples Qwikresume

As A 25 Year Old Software Developer In The Us Is There Any Way To Achieve Financial Freedom Before 40 Other Than Quitting My Comfortable Job For A Risky Startup Or Putting My

Household Budget Worksheet Simple Monthly Budget Template Simple Monthly Budget T Budgeting Worksheets Budget Template Printable Household Budget Worksheet

I Am 22 How I Can Achieve Financial Freedom At The Age Of 30 Quora

9 Free Sample Home Mortgage Checklists Printable Samples

9 Free Sample Home Mortgage Checklists Printable Samples

Pin On Budget Template

Home Connolly Capital

As A 25 Year Old Software Developer In The Us Is There Any Way To Achieve Financial Freedom Before 40 Other Than Quitting My Comfortable Job For A Risky Startup Or Putting My

E Paper 22 July 2016 Section C The Punjab Guardian By The Punjab Guardian Newspaper Issuu